Feds flag human services grants shakeup

Posted on 10 Dec 2025

The federal government is trialling longer-term contracts for not-for-profits that deliver…

Posted on 05 Mar 2025

By Matthew Schulz

Government tax reforms affecting community foundations are expected to significantly boost philanthropy in Australia, with the sector set to manage more than $1 billion within the next few years.

New tax rules now in force provide for a “community charity” category, which gives community foundations the highly sought-after deductible gift recipient (DGR) status.

The tax benefit will further increase revenue for Australia’s growing number of community foundations and has strong federal government backing.

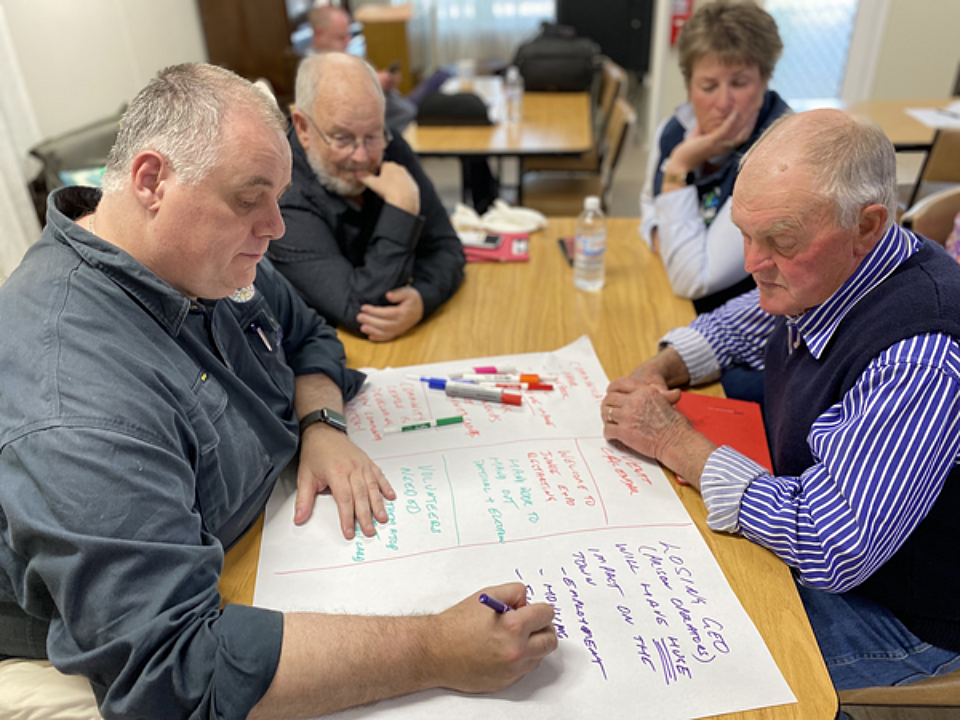

Community foundations pool donations from individuals, businesses and institutions to fund their works. Each operates as a permanent, independent trust that invests funds to generate grants for charities and grassroots projects in specific regions.

The sector has grown rapidly, with 40 foundations currently in operation.

Since the tax reforms were announced in June last year, the peak body Community Foundations Australia has seen 74 more communities announce their intention to create a foundation. Those groups are expected to launch in the next two years.

“This will be the fastest growing foundation field in the world, and with this groundbreaking legislation, this puts Australia at the forefront of the international community philanthropy field."

Community Foundations Australia chief executive Ian Bird told Grants Management Intelligence this week, in between a series of Canberra meetings and a media conference about the changes, that foundations already manage endowments worth $650 million, an amount projected to surpass $1 billion by the 2027–28 financial year.

Bird said Australia’s community foundations sector was now the fastest-growing movement of its type globally, and the foundations collectively formed Australia’s largest philanthropic network.

“This will be the fastest growing foundation field in the world, and with this groundbreaking legislation, this puts Australia at the forefront of the international community philanthropy field,” Bird said.

While legislative changes encouraged donors, funds were being created by communities undergoing energy transitions such as closure of coal mines, or by communities preparing for climate impacts, such as fires and floods.

Bird said that community foundations were distinctive in Australia’s philanthropic scene for their high rates of distributions.

While the minimum spend-down of philanthropic funds is legislated as four to five per cent of total funds each year, Bird said a 14 per cent annual spend was the average for community foundations, and some groups were known to expend 100 per cent of available funds for specific purposes.

Foundations distributed a record $70 million last year, but Bird said that by the end of the decade, community foundations would be pouring “well over $100 million” annually into their communities.

Bird compared Australia’s growth to Canada’s: as CEO of Community Foundations of Canada he guided the development of community foundations from funds of $1 billion to $10 billion and the growth of foundation numbers from 100 to more than 250.

The tax rule changes have been welcomed by the peak bodies Community Foundations Australia and Philanthropy Australia, which predicted the reforms would boost social capital and grassroots giving.

The changes, outlined in Taxation Administration (Community Charity) Guidelines 2025, were released by Charities Minister Andrew Leigh, with bipartisan support.

Community Foundations Australia chair Ben Rodgers hailed the government’s “practical action” to support community philanthropy in Australia.

“The implementation of this reform brings more than 20 years of sector-wide advocacy to a successful close, creating a new and better tax and regulatory framework for community foundations, in recognition of the vital role they play building thriving communities across Australia,” Rodgers said.

Rodgers explained that until now, community foundations had faced barriers attracting donations from private ancillary funds used by individuals and families for private giving, which were “constrained” from directly supporting community groups without DGR status.

The new DGR category and guidelines for community foundations created a “more fit for purpose environment for community philanthropy in Australia”, he said.

“It’s an exciting time for community philanthropy in Australia.”

Philanthropy Australia chief executive Maree Sidey said the reforms “remove big roadblocks, helping unlock the flow of more resources to important community initiatives”.

She said the changes would help the government’s goal of doubling giving by 2030, and flagged that ahead of the federal election, “there’s an opportunity for both the Government and Opposition to build on this with further practical reform commitments aimed at growing giving for the benefit of the community”.

Charities Minister Andrew Leigh said in a media statement that the government was delivering on promises to support the philanthropic sector, and the latest announcement was an important step towards the government’s goal of doubling philanthropic giving by 2030.

“These reforms will make it easier for people to support charitable foundations in their local area,” the minister said.

“By reducing the paperwork burden and expanding eligibility for tax‑deductible donations, the Albanese Government is ensuring that more money flows to charities that are making a real difference in people’s lives.”

Dr Leigh had earlier singled out community foundations as a vehicle for boosting philanthropy, telling the Philanthropy Australia conference last year that such foundations could become the engine room of philanthropy in Australia.

He described community foundations as “democratic”, “egalitarian” and a model which “matches the government’s ambition for charities and for philanthropy.”

Charities are still waiting on further reforms to DGR rules as recommended by the Productivity Commission’s Future Foundations for Giving report.

Posted on 10 Dec 2025

The federal government is trialling longer-term contracts for not-for-profits that deliver…

Posted on 10 Dec 2025

Just one-in-four not-for-profits feels financially sustainable, according to a new survey by the…

Posted on 10 Dec 2025

The Foundation for Rural & Regional Renewal (FRRR) has released a new free data tool to offer…

Posted on 10 Dec 2025

A major new report says a cohesive, national, all-governments strategy is required to ensure better…

Posted on 08 Dec 2025

A pioneering welfare effort that helps solo mums into self-employment, a First Nations-led impact…

Posted on 24 Nov 2025

The deployment of third-party grant assessors can reduce the risks to funders of corruption,…

Posted on 21 Oct 2025

An artificial intelligence tool to help not-for-profits and charities craft stronger grant…

Posted on 21 Oct 2025

Artificial intelligence (AI) is becoming an essential tool for not-for-profits seeking to win…

Posted on 21 Oct 2025

A new measurement tool designed by First Nations experts is challenging the way grantmakers assess…

Posted on 21 Oct 2025

Funders and the not-for-profits (NFPs) they work with should treat artificial intelligence (AI) as…

Posted on 21 Oct 2025

Tweens and young teens are set to benefit the most from an Australian investment company’s renewed…

Posted on 21 Oct 2025

The Western Australian government has updated its grants administration guidelines, with the new…